July 15, 2025

Monthly report on bank performance, May 2025

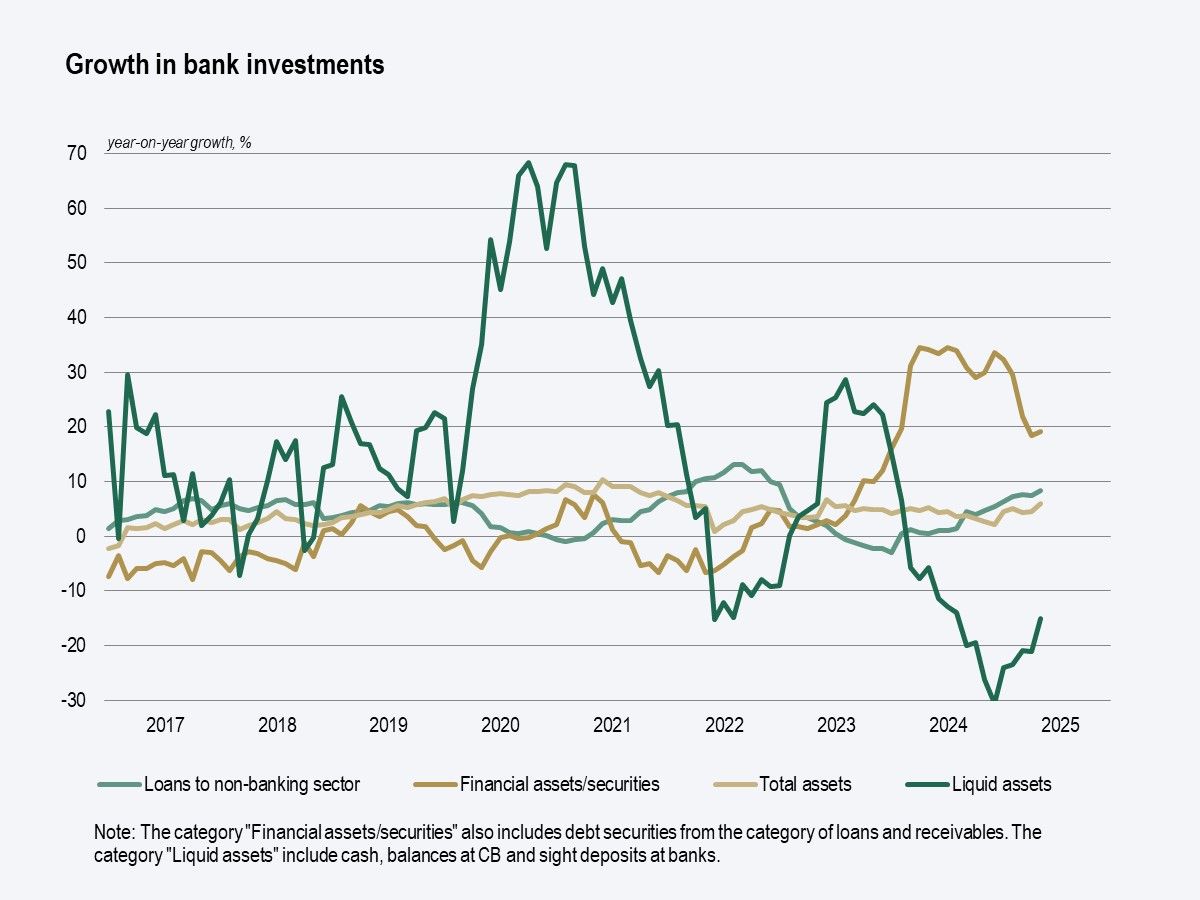

In May, the total assets of banks increased significantly, rising by EUR 1,469 million. Among the sources of financing, the growth of household deposits stood out, along with the additional issuance of debt securities aimed at meeting the MREL requirement. Capital also increased year-on-year due to a larger volume of dividends, which banks received somewhat earlier this year than in 2024.

Photo: Banka Slovenije

Publications

Current data

Event calendar

Financial literacy

Would you like to visit Banka Slovenije? Do you know where you can find Atlas's Secret? Are you interested in The Lost Money Hunt?

You can take part in our financial literacy programmes by visiting our education days or doing a guided tour of the Banka Slovenije Museum, where we explain the central bank's key tasks in a fun and interactive way. Moreover, primary school children can join us on our special holiday days, whereas throughout the school year we organise school projects, such as Masters of the Digital Future and Bodi FIN.

Are you still unsure? Then we recommend watching Banka Slovenije youth TV series Young Masters of Finance and taking an adventure with the main protagonists.

Our programmes are available for all ages and are free of charge.

You are most welcome.

User help

Frequently searched topics