Macroeconomic environment

February 16, 2026

Further slowdown in economic growth last year

Economic growth slowed further last year to record its lowest rate since 2020, largely as a result of a contraction in the economy in the early part of the year. The growth was mostly based on private consumption and government spending, but continued to be held back in particular by weak foreign demand and the accompanying weakness of corporate investment. Banka Slovenije is expecting economic growth to strengthen this year.

Current posts

In focus

New tool for real-time assessment of economic growth in Slovenia

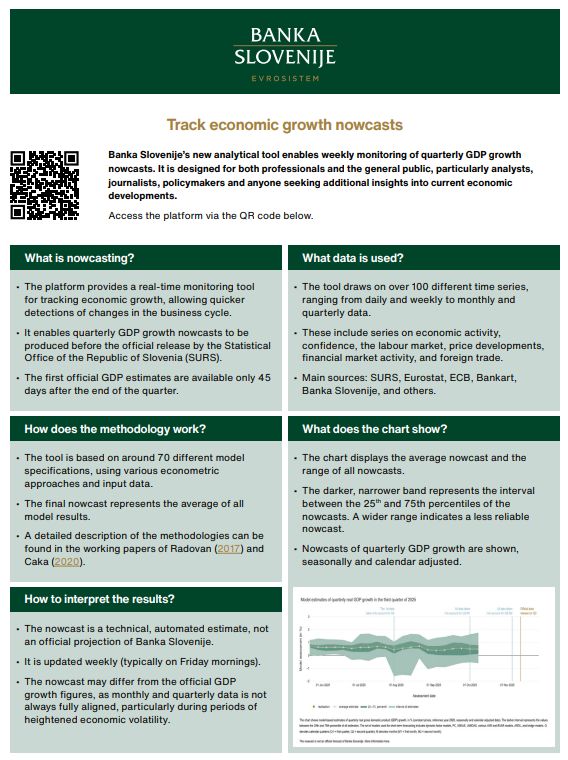

A new GDP nowcasting tool is now available on our website. The tool provides real-time estimates (nowcasts) of quarterly economic growth, offering an earlier insight into current economic developments before official GDP data are released. Similar approaches are also used by several other central banks, including the Bank of Finland and the Federal Reserve Bank of New York.

The estimate is based on a broad set of more than one hundred high-frequency indicators, covering data on economic activity and sentiment, the labour market, the balance of payments, financial markets and prices, as well as conditions in key export markets. The tool combines results from around 70 different model specifications, allowing for a display of both the average estimate and the confidence range. It is automatically updated, typically on Friday mornings, and does not represent an official projection of Banka Slovenije. The nowcast serves as an analytical support tool for monitoring economic developments. However, in periods of heightened volatility or following data revisions, results may differ from subsequently published official statistics.

For more information, see the Press Release.

Model-based nowcasts of quarterly GDP growth

Current data

Economic publications

Review of macroeconomic developments and projections, December 2025

Review of macroeconomic developments, September 2025

Research publications

Nik Gabrovšek: Uncertainty indicators for the Slovenian economy

Nik Gabrovšek, Domen Pavlič: Media attention on inflation: Evidence from over 600,000 web scraped news articles

Matjaž Volk: Pricing Risk or Rationing Credit? Bank Behaviour in a Tightening Monetary Cycle

Luka Žakelj, Mojca Lindič: Immediate macroeconomic importance of the pharmaceutical sector