In recent years, as part of its climate strategy, Banka Slovenije has been strengthening its holdings of green, social and sustainable bonds. We increased our holdings by almost EUR 180 million over the course of 2024 to end the year at EUR 625 million, equivalent to almost 11% of our holdings of financial assets. Last year we also reduced the carbon footprint of our portfolio of non-financial corporate bonds by 22% and that of our portfolio of shares by 40%. This strategy of socially responsible and sustainable investing is reducing the climate risks to which we are exposed via our holdings of financial assets.

Banka Slovenije is following the EU climate neutrality strategy, and is pursuing a strategy of socially responsible and sustainable investing, which it put in place in 2023. Accordingly we publish climate-related disclosures for our own portfolio of financial assets each year. The aim is to contribute to greater transparency with regard to climate risks and opportunities within the framework of Banka Slovenije’s portfolio of financial assets, and at the same time to increase public awareness and understanding with regard to climate risks.

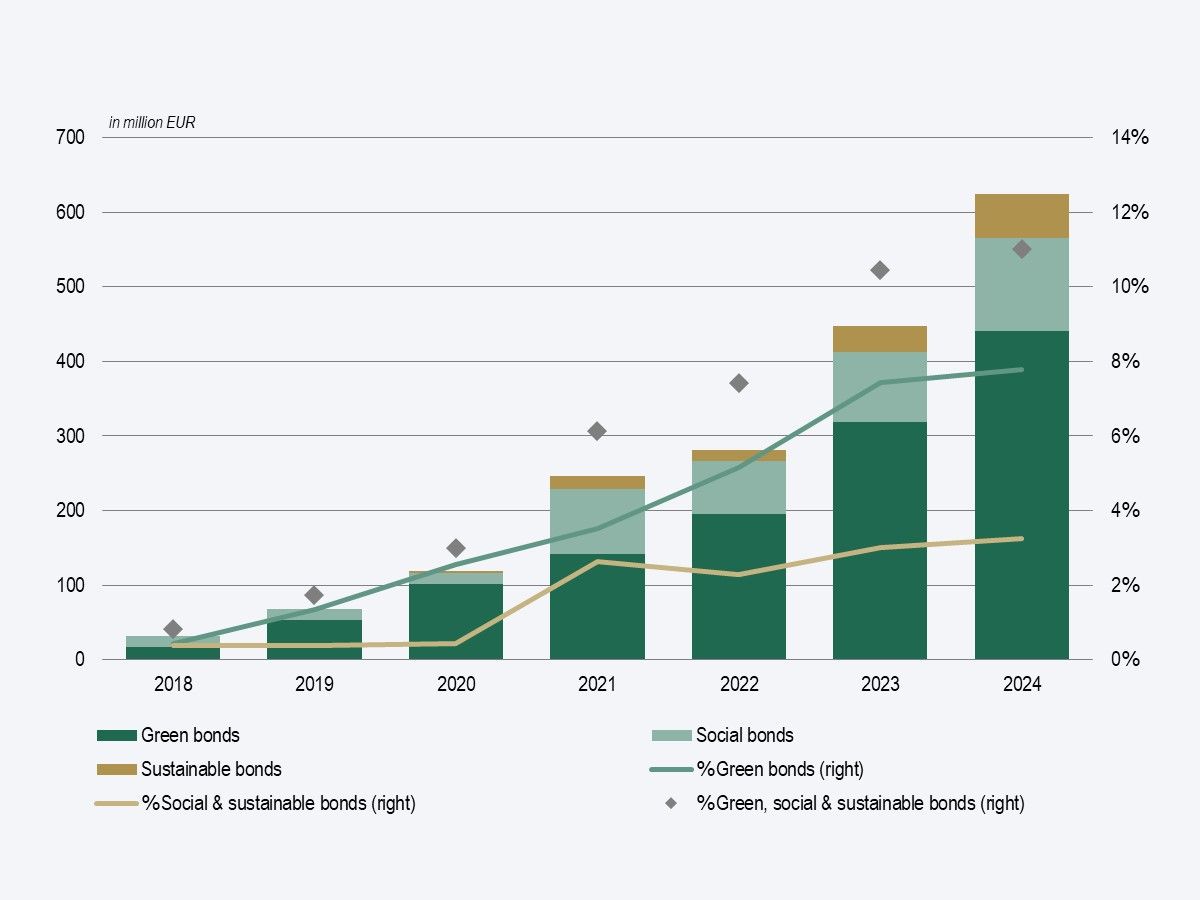

Holdings of green, social and sustainable bonds

The last seven years have seen us sharply increase our holdings of green, social and sustainable bonds. By increasing investment of this kind, last year we continued to support the financing of projects that actively contribute to the decarbonisation of the economy and to the general improvement of the public’s socioeconomic position. Holdings of bonds of this kind amounted to EUR 32 million at the end of 2018, or less than 1% of our total financial assets, but almost EUR 625 million at the end of 2024, equivalent to more than 11% of our portfolio of financial assets. Last year’s increase in holdings of this kind stood at almost EUR 180 million.

Figure: Holdings of green, social and sustainable bonds

Sources: Bloomberg, Banka Slovenije calculations

Last year we additionally reduced the weighted average carbon intensity of our portfolio of non-financial corporate bonds by approximately 22%, and that of our portfolio of shares by approximately 40%. This leaves the weighted average carbon intensity approximately 60% below the benchmark indices in the case of our portfolio of non-financial corporate bonds, and approximately 40% below in the case of our portfolio of shares.

Banka Slovenije targets for the years ahead

In accordance with the EU climate neutrality strategy, it is our long-term target to come as close as possible to net zero greenhouse gas emissions in our own asset portfolio by 2050. We will thus continue working to gradually improve the climate-related metrics of our financial assets.

To help in meeting our long-term target, we set two medium-term milestones to meet by the end of 2025. The first we have already met, in that our holdings of green, social and sustainable bonds now exceed the target of EUR 600 million. Meanwhile within the framework of the second medium-term milestone we will continue reducing the carbon footprint of our holdings of private-sector issuers, namely corporate bonds (financial and non-financial), covered bonds and shares.

Climate-related disclosure of Banka Slovenije’s own financial assets, May 2025