Macroprudential restrictions on household lending (valid to 30. 6. 2023)

The Governing Board of the Bank of Slovenia, pursuant to the first paragraph of Article 31 of the Bank of Slovenia Act (Official Gazette of the Republic of Slovenia, No. 72/06 – official consolidated text, 59/11, 55/17, 5/18) and Articles 4, 17, and 19 of the Macroprudential Supervision Act (Official Gazette of the Republic of Slovenia, No. 100/13), adopted the Regulation on Macroprudential Restrictions on Consumer Lending (Official Gazette of the Republic of Slovenia, No. 60/22).

The Regulation on macroprudential restrictions on consumer lending (hereinafter: the Regulation) adapts and upgrades the macroprudential restrictions already introduced by the Regulation on macroprudential restrictions on lending to the population (Official Gazette of the Republic of Slovenia, Nos. 64/19 and 75/20). The measure applies to banks, savings banks, branches of member banks, and branches of third-country banks in the Republic of Slovenia (hereinafter referred to as banks). The aim of the measure is to mitigate and prevent excessive credit growth and excessive financial leverage.

Main changes

The main changes brought about by the new Regulation are:

Changes related to allowed DSTI deviations. Until now, even in the case of allowed deviation the borrower had to be left with at least 76 % of the gross minimum wage plus the amount for (possible) family members after debt service costs were subtracted from his/her salary. From now on, this restriction is being removed, but the condition that DSTI does not exceed 67 % remains. The additional risks arising from the adjustment of conditions for allowed deviations are addressed by the implementation of two sectoral systemic risk buffers (link).

Differentiated LTV recommendation. The recommendation regarding the ratio of loan to value of residential real estate collateral (LTV) has been revised as a result of increased risks on the real estate market owing to strong increases in house prices and overvaluation. The recommended value of LTV has been reduced from 80 % to 70 %, except for buyers acquiring primary property.

Bridging loans secured by financial instruments are exempt from the DSTI cap. These loans are subject to a maturity cap of three years and a cap on the ratio of loan to value of financial instruments used as collateral (LTC). LTC should not exceed 70 % at the time the loan is granted.

Housing loans with state guarantee are exempted from the Regulation. The limits of the Regulation will not apply to residential real estate credit agreements secured by a guarantee of the Republic of Slovenia which are treated as direct exposures to the Republic of Slovenia for the purpose of calculating the capital requirement for credit risk in accordance with Article 114(4) of the Regulation 575/2013/EU. In practice this means that loans are granted under the Housing Guarantee Scheme Act for Young People (OG RS, no. 54/22) are exempt from macroprudential restrictions.

Alternative way of calculating creditworthiness for sole proprietors with normalised expenses. An alternative way of calculating creditworthiness is introduced for sole proprietors with normalised expenses who are applying for credit as consumers. Under the current rules, that follow the tax legislation, up to 20 % of income generated from business activity less taxes and contributions may be considered as consumer’s income. Under the new rules the bank can estimate the consumer’s income on the basis of the actual income and expenses generated from business activity as derived from financial statements (if they available), less taxes and contributions.

A change in the manner of calculating the quota for the allowed deviations. The quota will be calculated on the basis of transactions that comply with binding macroprudential restrictions and were approved in the previous (no longer in the current) quarter. This change will simplify the application of deviations, as banks will know at the start of the quarter what amount of allowed deviations they may grant.

Applicable macroprudential instruments

The Regulation sets out three binding macroprudential instruments:

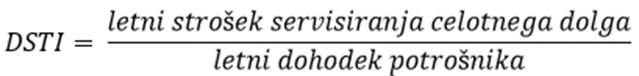

(a) a cap on the ratio of the annual debt servicing costs to the consumer’s annual income (DSTI) when the loan agreement is concluded,

(b) a cap on loan maturity,

(c) a cap on the ratio of the amount of bridging loan collateralised by financial instruments and the value of financial instruments (LTC) when the credit agreement is concluded,

and a non-binding macroprudential instrument:

(d) a recommendation with regard to the maximum ratio of the amount of a loan for residential real estate to the value of the real estate pledged as collateral (LTV) when the credit agreement is concluded.

Macroprudential instruments implement minimum credit standards for housing and consumer loans, but banks remain responsible for assessing borrowers’ creditworthiness and for bearing the risk arising from new loans.

Cap on DSTI

The cap on DSTI applies to all new loans to consumer (consumer loans and housing loans). The DSTI ratio is calculated as follows:

.png)

The annual total debt servicing costs include the costs of servicing the loan that is the subject of the new credit agreement, and the amounts of all other outstanding credit agreements, including lease agreements, other than debts related to credit cards and credit limits. Loans that will be repaid under a new credit agreement are also not included in the debt. The consumer’s annual net income includes earnings from all income sources defined by the law governing personal income tax that are not exempt from attachment, with the exception of one-off and occasional earnings (e.g. jubilee benefits and extraordinary bonuses). Regardless of the previous sentence refund of personal income tax may be taken into account.

The cap on DSTI sets the highest allowed DSTI. It depends on the consumer’s income, and the make-up of the household. When a new credit agreement is concluded, the DSTI ratio (at a monthly level) may not exceed:

a) 50% for net monthly income of no more than twice the minimum gross wage (in 2022 2,148.86 EUR), and

b) 67% for the portion of the net monthly income that exceeds twice the minimum gross wage.

c) Notwithstanding the income level, an amount of at least 76% of the minimum gross wage (in 2022 816.57 EUR) must remain for the consumer each month after the payment of all instalments under credit agreements. If the consumer is supporting a family member or another person that he/she is required to support by law, the amount of income stipulated for the person that he/she is supporting according to the criteria for allocating cash social assistance set out by the law governing social security benefits shall also remain for the consumer.

Up to 10% of consumer loans and 10% of housing loans approved by a bank each quarter may have a DSTI that exceeds the prescribed cap on DSTI.* The DSTI may not exceed 67%, and such loans must also comply with the limits on maturity. When a credit agreement has been concluded with multiple borrowers, the DSTI is calculated for each of them separately.

Cap on maturity

The Regulation also sets out the cap maturity of consumer loans that are not secured by residential real estate. This may not exceed 84 months (seven years).

Up to 15% of consumer loans approved by a bank each quarter may have a maturity of more than seven years.* The maturity of such loans may not exceed 120 months (ten years), and they must also comply with the cap on DSTI.

For bridging loan secured by financial instruments maturity should not exceed 36 months (three years).

Cap on LTC

The Regulation sets a cap on LTC ratio for bridging loans collateralised by financial instruments. The LTC ratio is calculated as:

.png)

The value of the LTC should not exceed 70 % at the time of loan approval. There are some other restrictions on bridging loan secured by financial instruments with respect to the financial instruments that may be posted as collateral.

Recommendation regarding the maximum LTV

The recommendation regarding the maximum LTV ratio applies to all loans secured by residential real estate (consumer loans and housing loans). The LTV ratio is calculated as:

.png)

It is recommended that, when the credit agreement secured by residential property is concluded, the value of LTV should not exceed 70 %, except when the consumer is purchasing, renovating or building their primary property. Primary property is a property that is subject to purchase, construction or renovation, is pledged as collateral and where the consumer will have a permanent residence.

Macroprudential restrictions on household lending, in force until 30 July 2022

On the 30 June 2022 the Regulation on macroprudential restrictions on household lending (Official Gazette of the Republic of Slovenia, Nos 64/19 and 75/20) will cease to apply, with the exception of Article 9a (taking account of income during the COVID-19 epidemic), which will apply until 1 September 2022. Macroprudential restrictions on household lending applicable until 30 June 2022 are available on this link.

Notes:

*The basis for calculating the quota for allowed deviations are new loans granted in the previous quarter that complied with the binding restrictions. The quota is calculated separately for consumer and housing loans.

V letni strošek servisiranja celotnega dolga se vključujejo stroški servisiranja kredita, ki je predmet nove kreditne pogodbe, ter zneski vseh ostalih neporavnanih kreditnih pogodb, tudi leasinških, z izjemo dolgov, povezanih s kreditnimi karticami in limiti. V dolg se prav tako ne vključuje kreditov, ki bodo z novo kreditno pogodbo poplačani. V letni neto dohodek potrošnika so vključeni prejemki iz vseh dohodkovnih virov, kot jih opredeljuje zakon o dohodnini, ki niso izvzeti iz izvršbe, z izjemo enkratnih in občasnih prejemkov (npr. jubilejne oziroma izredne nagrade). Ne glede na napisano se v dohodek lahko upošteva vračilo dohodnine.

Instrument omejitve razmerja DSTI določa najvišje še dovoljeno razmerje DSTI. To je odvisno od dohodka in sestave gospodinjstva potrošnika. Ob sklenitvi nove kreditne pogodbe razmerje DSTI (izraženo na mesečni ravni) ne sme preseči:

a) 50 % za mesečni neto dohodek, ki je nižji od ali enak 2-kratniku minimalne bruto plače (v 2022 2.148,86 EUR), in

b) 67 % za del mesečnega neto dohodka, ki presega 2-kratnik minimalne bruto plače.

c) Ne glede na višino dohodka mora potrošniku po plačilu vseh obrokov iz naslova kreditnih pogodb ostati najmanj znesek v višini 76 % minimalne bruto plače (v 2022 816,57 EUR). Če potrošnik preživlja družinskega člana ali drugo osebo, ki jo mora preživljati po zakonu, mu mora ostati tudi znesek v višini prejemka, določenega za osebo, ki jo preživlja, po merilih, ki jih določa zakon, ki ureja socialno varstvene prejemke, za dodelitev denarne socialne pomoči.

Banka lahko vsako četrtletje odobri do 10 % potrošniških in 10 % stanovanjskih kreditov z razmerjem DSTI, ki presega predpisano najvišje razmerje DSTI.* To razmerje ne sme preseči 67 %, hkrati pa morajo biti ti posli skladni z omejitvijo ročnosti. Če kreditno pogodbo sklene več kreditojemalcev, se DSTI izračuna za vsakega ločeno.

Omejitev ročnosti

Sklep določa tudi najdaljšo ročnost potrošniških kreditov, ki niso zavarovani s stanovanjsko nepremičnino. Ta ne sme presegati 84 mesecev (7 let).

Banka lahko vsako četrtletje odobri do 15 % potrošniških kreditov z ročnostjo nad 7 let.* Ročnost teh kreditov ne sme preseči 120 mesecev (10 let), hkrati pa morajo biti skladni z omejitvijo razmerja DSTI.

Za premostitvene kredite, ki so zavarovani s finančnimi instrumenti, ročnost ne sme preseči 36 mesecev (3 let).

Omejitev LTC

Sklep določa najvišjo višino razmerja LTC za premostitvene kredite, ki so zavarovani s finančnimi instrumenti. Razmerje LTC se izračuna kot:

Ob sklenitvi premostitvenega kredita, zavarovanega s finančnimi, vrednost LTC ne sme preseči 70 %. Za premostitvene kredite, ki so zavarovani s finančnimi instrumenti, obstajajo še nekatere druge omejitve glede finančnih instrumentov, ki so lahko dani v zavarovanje.

Priporočilo glede LTV

Priporočilo glede razmerja LTV velja za vsa posojila, zavarovana s stanovanjsko nepremičnino (potrošniška in stanovanjska). Razmerje LTV se izračuna kot:

Priporoča se, da ob sklenitvi kreditne pogodbe, zavarovane s stanovanjsko nepremičnino, vrednost LTV ne preseže 70 %, razen v primeru ko potrošnik nakupuje, gradi ali obnavlja primarno nepremičnino. Primarna nepremičnina je nepremičnina, ki je predmet nakupa, gradnje ali obnove, je dana v zavarovanje in kjer bo imel potrošnik stalno prebivališče.

Makrobonitetne omejitve kreditiranja prebivalstva, veljavne do 30. 6. 2022

S 30. 6. 2022 je prenehal veljati Sklep o makrobonitetnih omejitvah kreditiranja prebivalstva (Uradni list RS, št. 64/19 in 75/20) z izjemo 9a. člena (upoštevanje dohodkov v času epidemije COVID-19), ki je bil v veljavi do 1. 9. 2022. Makrobonitetne omejitve kreditiranja prebivalstva, veljavne do 30. 6. 2022, so na voljo na tej povezavi.

Pogosta vprašanja in odgovori s področja makrobonitetnih omejitev, so na voljo na tej povezavi.

Opombe:

*Osnova za izračun kvote za dovoljene izjeme so nova posojila, odobrena v preteklem kvartalu, ki so bila skladna z zavezujočimi omejitvami. Kvota se izračunava ločeno za potrošniška in stanovanjska posojila.