Bank Resolution Mechanism

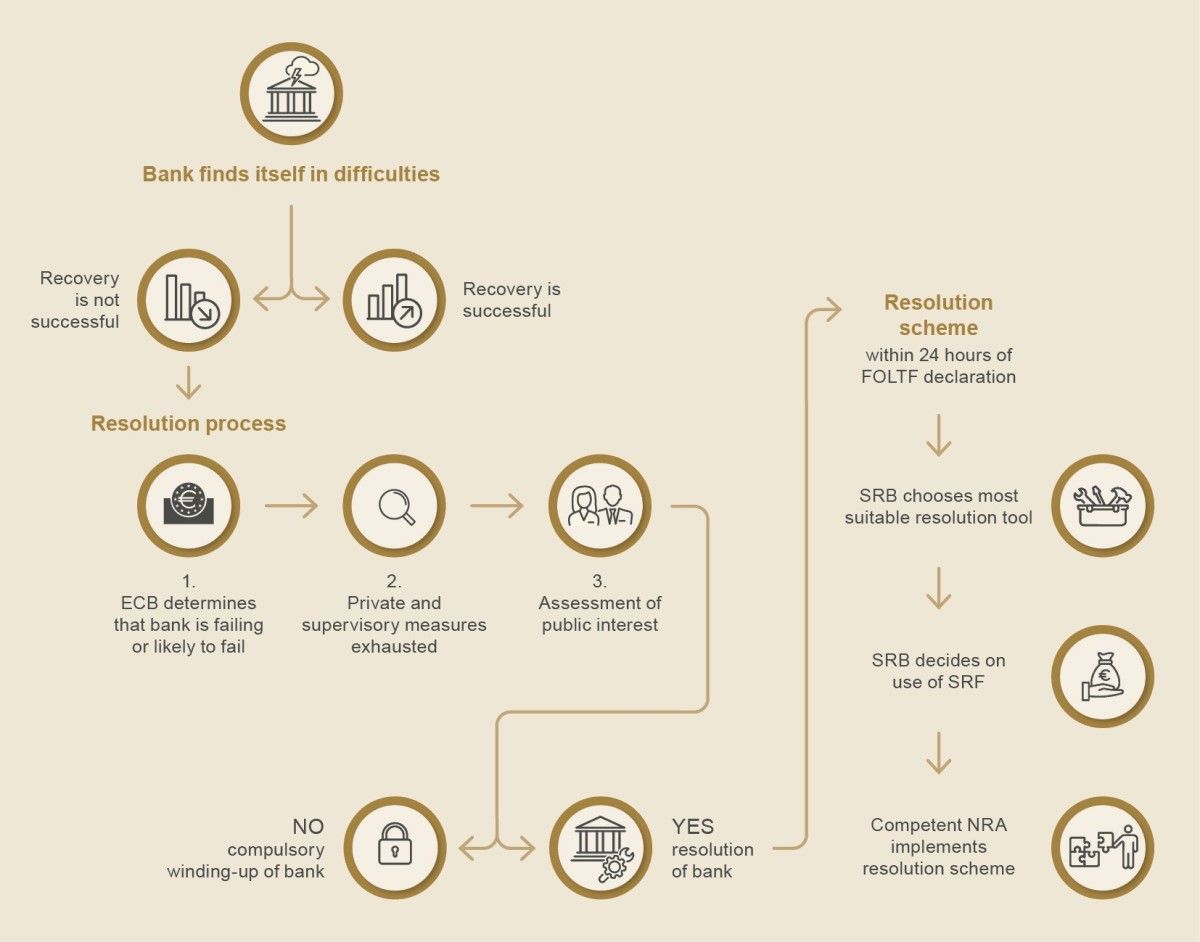

The official beginning of the bank resolution process occurs when recovery measures have failed and the bank’s difficulties have not been rectified.

Before any subsequent resolution proceedings, it is checked whether the difficulties faced by the bank are such that it is failing or likely to fail. The main indicators are liquidity difficulties (the bank is unable to settle its liabilities as they fall due) and insolvency (the bank has accumulated so many operating losses that its assets are less than its liabilities). There are other pathways to deciding that a bank is failing or is likely to fail: e.g. withdrawal of the banking license for various reasons, or state aid (not counting assets or aid received for the purpose of preventing serious disruption to the economy and maintaining the stability of the financial system).

This is followed by an examination of whether the bank can be resolved by means of supervisory or private measures, such as: liquidity assistance or recapitalisation secured by the bank itself, without the help of the regulator. If this is impossible, the subsequent treatment of the bank is taken over by the resolution authority.

Before any further actions are taken, the resolution authority checks whether it is in the public interest to put the bank through resolution. The assessment criteria are: a) whether the bank provides any critical functions or services for the economy, b) what the impact of the bank’s failure would be on financial stability in the country and the use of public funds, and c) the impact on the bank’s other creditors and debtors. If in light of the aforementioned factors the adverse consequences of the bank’s winding-up would be too large, there is a positive public interest in resolution. A positive public interest is a key element of the entire resolution process, upon which depends the decision to either continue with the resolution proceedings or to initiate wind-up proceedings at the bank, which in practice means involuntary liquidation proceedings.

The introduction of involuntary liquidation proceedings terminates the bank’s current operations. The deposit guarantee scheme ensures the repayment of covered deposits by the legal deadline, and the bank’s remaining creditors are repaid from the bank’s liquidated assets.

If there is a positive assessment of the public interest, activities to resolve the bank are initiated. The following principles are upheld in this process:

the shareholders of the bank under resolution are the first to bear losses,

after the shareholders of the bank under resolution, losses are borne by other holders of the bank’s capital instruments, and then the remaining creditors, in the reverse order of priority to that applying to the repayment of claims against the resolution entity in normal insolvency proceedings,

the management body and senior management of the bank under resolution are replaced, except in those cases where the retention of the management body and senior management, in whole or in part, as appropriate to the circumstances, is considered to be necessary for the achievement of the resolution objectives,

the management body and senior management of the bank under resolution must provide all assistance necessary for the achievement of the resolution objectives,

the liability of individuals and legal persons for the failure of the bank is enforced in accordance with the general rules on contractual liability, liability for damages and criminal liability,

the creditors of the same priority class are treated equally, except in cases for which the law provides otherwise,

no creditor of the bank may suffer greater losses than they would have suffered in the event that winding-up had taken place under normal insolvency proceedings,

covered deposits are fully protected.

Various tools are available for bank resolution: the bail-in, the sale of the bank or some of its assets, the establishment of a bridge bank, and asset separation and transfer. Their use depends on the reasons for the failure, the bank’s business model, the structure of the banking system, and the market situation.

A significant limiting factor in bank resolution is the time component: these days banks operate 24/7, while the increasing level of digitalisation means that other entities in the economy are now highly dependent on the operability of banks. All actions therefore need to be put in place over a very short timeframe, known as the “resolution weekend”. This reduces the disruption to the economy, and the bank can begin operating normally.

Single Resolution Fund

The Single Resolution Fund (SRF) is owned by the Single Resolution Board (SRB), which is responsible for the effective and consistent functioning of the Single Resolution Mechanism (SRM).

The SRB only uses the SRF for the purposes of ensuring the efficient application of resolution tools and the exercise of resolution powers, in line with the resolution objectives and principles governing resolution. The SRF is not used directly to cover losses or for the recapitalisation of the resolution entity. The SRF is being built up in accordance with the rules for pooling contributions collected at the national level, as set out in the Agreement on the transfer and mutualisation of contributions to the Single Resolution Fund. The target level of the SRF is available financial assets in the amount of at least 1% of covered deposits of all credit institutions authorised in all participating Member States, by 1 January 2024.

All banks established in Slovenia pay contributions to the SRF. For more about banks’ contributions to the SRF, see the SRB website.

Bank resolution fund

Banka Slovenije established a separate national bank resolution fund in 2015 on the basis of the Bank Resolution Authority and Fund Act (ZOSRB).

Under Article 62 of the new Resolution and Compulsory Winding-Up of Banks Act (ZRPPB-1B), the old bank resolution fund is continuing operations as the Bank Liquidation Fund, while the founding assets paid into the bank resolution fund are now considered contributions to the bank liquidation fund.

Paid-in contributions by bank (as at 30 March 2015)

Name of bank | Amount of cash contributed, EUR |

OTP banka d.d.1 | 62,928,318 |

Nova Ljubljanska banka d.d.2 | 60,886,056 |

UniCredit Banka Slovenija d.d. | 22,879,696 |

Addiko bank d.d.3 | 13,149,954 |

SKB banka d.d. | 12,930,512 |

Banka Intesa Sanpaolo d.d.4 | 10,618,282 |

Banka Sparkasse d.d. | 8,795,968 |

Gorenjska banka d.d. | 6,744,611 |

Deželna banka Slovenije d.d. | 2,700,110 |

Delavska hranilnica d.d. | 1,611,434 |

Hranilnica LON d.d. | 673,605 |

Primorska hranilnica Vipava d.d. | 82,903 |

Total | 191,070,937 |

OTP banka, d. d., operated under the name Nova KBM, d. d., until August 23, 2024. The amount includes the amount of initial contributions by Nova KBM and banks that merged with Nova KBM after 30 March 2015 – Abanka Vipa, d. d., and Banka Celje, d. d. (merged on 5 October 2015, legal successor to Abanka, d. d.). Abanka, d. d., (merged on September 1, 2020), Poštna banka Slovenije (merged on September 1, 2016), KBS banka (merged on January 3, 2017) and SKB banka (merged in August 2024). KBS banka operated with Raiffeisen banka until July 1, 2016. The table shows the total amount of contributions to the resolution fund as at 30 March 2015, with Abanka Vipa contributing EUR 14,565,041, Banka Celje EUR 10,181,404, Nova KBM, d. d., EUR 14,251,501, Poštna banka Slovenije EUR 1,399,252.00, KBS banka EUR 9,600,608.00, and SKB banka EUR 12,930,512.

Includes the founding contributions of NLB and N Banka, which was absorbed by NLB d.d. on 1 September 2023. N Banka traded as Sberbank banka until 12 April 2022. NLB’s founding contribution amounted to EUR 44,536,835 and N Banka’s to EUR 16,349,221.

Addiko banka d.d. traded as Hypo Alpe Adria bank d.d. until 11 July 2016.

Banka Intesa Sanpaolo d.d. traded as Banka Koper d.d. until 16 January 2017.

Bank Liquidation Fund

The fund is financed by contributions from banks and savings banks established in Slovenia. The fund’s assets may be used for financing the implementation of involuntary liquidation measures imposed by Banka Slovenije for:

the contribution of the initial capital of the asset management vehicle established in accordance with Article 212 of the Resolution and Compulsory Winding-Up of Banks Act (ZRPPB-1B) when the net value of the bank’s assets that are being transferred is higher or equal to the net value of the bank’s liabilities that are being transferred to the asset management vehicle by applying the asset separation tool;

the payment of consideration to the bank when the fund, as the acquirer, is taking over the assets, rights and obligations of a bank undergoing involuntary liquidation proceedings by applying the sale of business tool;

loans, guarantees, sureties or other collateral provided in connection with involuntary liquidation measures;

loans to the Deposit Guarantee Fund established on the basis of the Deposit Guarantee Scheme Act for the purposes of providing liquidity for the payment of covered deposits.

The target level of the fund’s assets, which are assets of the banks and are managed separately from other assets at Banka Slovenije, is 3.0% of total covered deposits in Slovenia as at 30 September 2014. The banks provided founding assets in the amount of 1.3% of total covered deposits via founding cash contributions, and are also required to be capable of providing cash in the amount of 1.7% of covered deposits to the fund at any time. Accordingly they are required to structure liquid assets in the form and in the manner set out by the Regulation on liquid assets for the purpose of the resolution fund.

Investment policy and management fees

Banka Slovenije sets the bank liquidation fund’s investment policy to ensure the security, low risk and high liquidity of the fund’s assets. The Governing Board of Banka Slovenije set out the bank liquidation fund’s investment policy and the package of management fees to be covered by Banka Slovenije in accordance with the ZRPPB-1 and charged against the fund’s assets via the Regulation on the investment policy and management fees of the bank liquidation fund. Since 1 January 2019 Banka Slovenije has managed the fund’s assets in a joint fund together with the assets of the deposits guarantee fund. By law, the bank liquidation fund will cease its operations on 31 December 2030.